In the early days, when Blogging and Freelancing were new fields, payments worldwide were only possible through Paypal. Today, things are pretty different, and plenty of Paypal alternatives are more genuine and guarantee easy prices across the globe.

Many Paypal alternatives have their websites (similar to Paypal) that are rich in features, so you don’t have to worry if you don’t have a Paypal account.

Here are the nine best money transfer websites to choose from:

1.Payoneer

The most helpful thing about Payoneer is that it won’t charge you for signing up, but the site will reward you with a $25 bonus for a $1,000 transaction amount. There are three different fee levels, depending on the payment method:

- For direct credit card payments – who will charge a fee of 3% of the transaction amount?

- For transferring the money to a local bank – which will charge an account fee of $1.50 of the transaction amount

- For withdrawing cash in another currency – who will charge 2% of the transaction amount?

Signing up with Payoneer is a straightforward process, but the drawback here is that the transaction fees are slightly higher than Stripe and Paypal fees.

2.Stripe

The best part of using Stripe as a payment method is that it is elementary and has lower charges. Plus, the process of inclusion into the most popular WordPress eCommerce platforms (WooCommerce and Shopify) is more straightforward. In addition, Stripe provides several debit and credit cards that can use in more than 13 nations. And not only that, but with Stripe, you can create freelancer payments.

Another thing to know about Stripe is who can use it to accept both one-time and recurring payments. This payment technique means you can use it for a fixed/monthly fee and simultaneously be international with your online business as a freelancer or blogger.

This payment method is better because it has no monthly fees and won’t charge you at all for the installation process. Plus, the general cost for a transaction is 2.9%+ 30 cents/transaction.

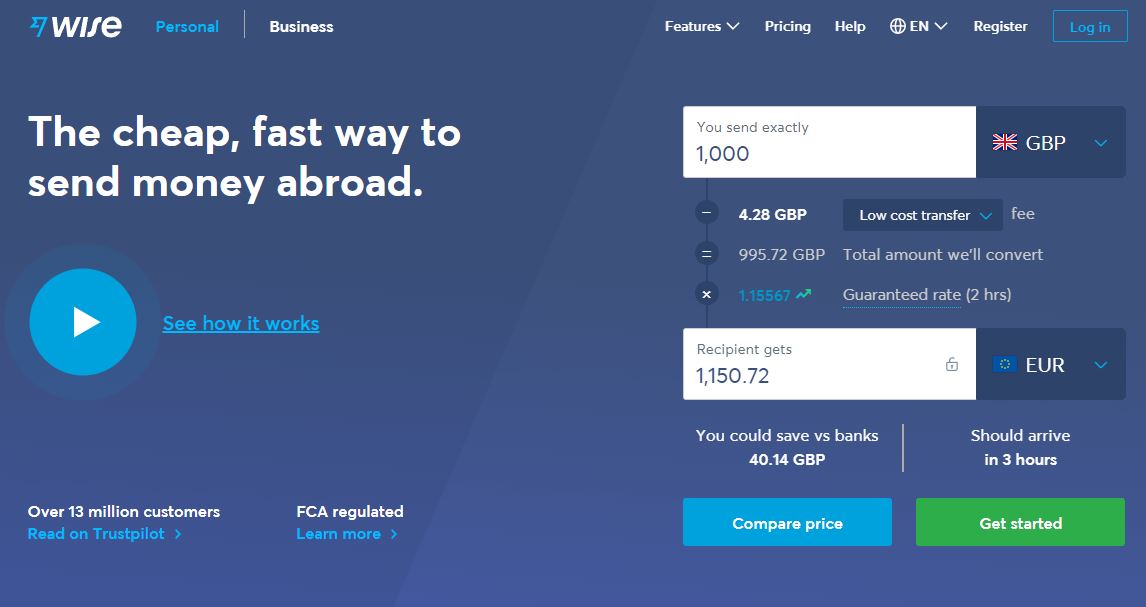

3.TransferWise (Wise from 2021)

The first thing to know about TransferWise is that it is one of the cheapest Paypal alternatives. In addition, TransferWise has a multicurrency borderless account, which means it can quickly help you with your freelancing business while receiving money at a very minimal fee.

What’s more about TransferWise is that it is transparent regarding pricing approaches – it sticks to flat pricing. This is how it works: you create an account and then send payment requests to your customers – pretty easy, right? Then the customer establishes the account in TransferWise through which he can pay with his credit card. Immediately, all platform and transaction costs will be visible to all your clients.

4.2CheckOut

2Checkout, also called 2CO, is a highly rated website considered one of the best Paypal payment alternatives. 2CO offers 15 languages, 87 currency options, and eight different payment types in over 200 worldwide markets. There are two main disadvantages of 2CheckOut :

- It requires you to use another invoicing software for your online business.

- It doesn’t support direct transactions.

However, you can process your payments via credit cards and Paypal without having a Paypal account. The signup process is simple, and they offer great support, enabling a smooth experience on this payment Paypal alternative.

5.Skrill

Skrill is another great Paypal alternative that guarantees easy payments worldwide – better than Payoneer. First, you need to create an account, make payments, and withdraw funds. You can also use the Skrill MasterCard if you want to withdraw from an automated teller machine (ATM) or shop online worldwide. Furthermore, Skrill also has an Android and iPhone app that can help you do your transactions through the phone.

6.Remitly

What you should know about Remitly is that it is perfect for running great ad deals and takes no charge for +$1,000 transfers. It is elementary to process; you log into your Remitly account and then transfer cash to your card. You can produce your payments through your credit or debit card.

There is also a fee-fee choice that can help you send payments, but the struggle is that this would take up to 3 days. So, if in a hurry, this is not the best option possible.

But there are some advantages, too; for example, if you are an Indian citizen, Remitly provides full coverage nationwide, and you can transfer your money to over 130 banks.

7.Instamojo (Indian)

Instamojo is a company based in Bangalore, mainly selling digital goods and collecting online payments. The fastest way to send payments using Instamojo is to use your email address or @username. And by giving your username to other people, you can also receive payments. This payment method has many alternatives available for today’s freelancers and entrepreneurs. Instamojo doesn’t have setup fees, and they only charge you 2%

Rs.3 for every transaction completed successfully.

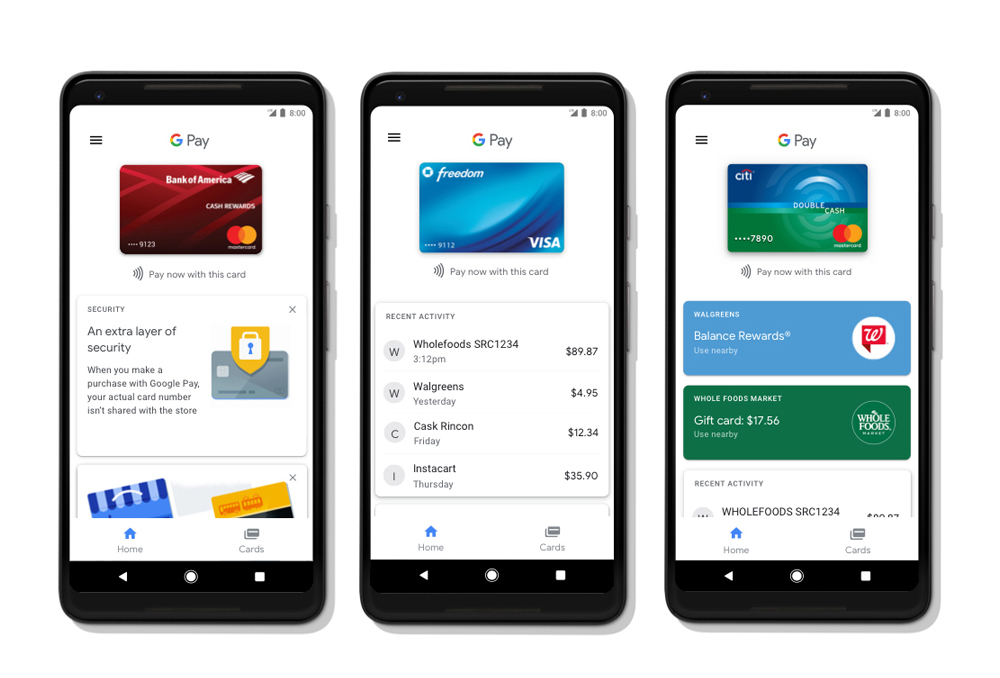

8.Google Pay

It will be impossible to write an article without including Google. And here it is, Google Pay, a great and easy-to-setup option for your payments. What you must know is that Google Pay is by far the best Paypal payment alternative – it takes less than 2 minutes to set up. Plus, they won’t charge you for the transaction. First, your clients need a credit or debit card linked to the Google pay wallet. Then, they need to enter every transaction’s password or the OTP. What makes Google Pay a great Paypal option is that it is possible to send payments from your phone, and you can do it in 2 ways; online/in person. On top of that, with Google, you don’t have to worry about security.

9.Dwolla

If you are interested in making frequent bank transfers, Dwolla is a good alternative for your payments. But different from Paypal, which uses Cards, Dwolla connects directly with your bank account. In this way, Dwolla can promote the transfer of funds.

The best part of all this (removing cards from usage) is that the transaction fees are low. Plus, this payment method allows you to send payments from your phone at really low costs.